Case Study: Tech Startup (San Francisco, California)

Early-stage company planning an on-demand remote computer repair and technical support service delivered over the internet.

Engagement Snapshot

- Results: Prepared Business for Fundraising

- Engagement Dates: 2008

- Industry: Remote computer repair and technical support

- Location: San Francisco, California

References Policy

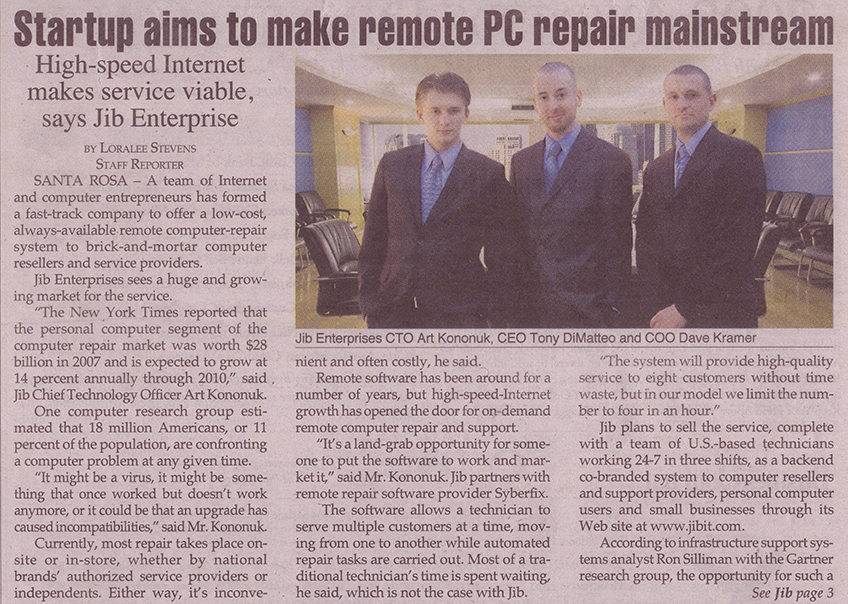

My work with clients is confidential by default. Most engagements involve sensitive operational details, financial context, internal team dynamics, and customer data. I do not disclose client information, internal documents, or private communications unless the client has explicitly authorized it.Any public examples on this website are shared only to the extent a client has approved. In some cases, clients have given permission for limited disclosure such as photos together, a short written quote, or select clips from recorded coaching sessions. When those assets appear, they reflect client consent for that specific use only and do not imply broader permission to share additional details.If you are considering hiring me and would like references, I can provide them when appropriate, subject to client availability and confidentiality constraints. In all cases, I will protect client privacy and honor any restrictions requested by the client.Executive Summary

This company had a plausible technical concept but needed operational credibility and investor readiness. The primary constraint was a gap between the idea and an executable plan that outsiders could trust: a defined delivery workflow, an aligned go-to-market story, and financial assumptions tied to real operating capacity. In 2008, the work focused on translating the concept into a structured operating model and building the assets needed for fundraising and early market validation.

Outcomes were documented as measurable targets and investor-grade materials. The plan included explicit scaling commitments, a multi-year pro forma, and a capital plan designed for investor conversations. The website was rebuilt as a practical sales and diligence asset to communicate the offer and capture early interest.

Starting Point:

- Execution reliability was not yet encoded into a defined service workflow with clear steps from intake through follow-up.

- Financial visibility needed to connect pricing and customer volume assumptions to staffing, costs, and throughput.

- Fundraising readiness required a coherent narrative, terms, and a capital plan that investors could diligence.

- Market-facing clarity needed improvement so prospects and partners could understand the model in plain language.

Objectives for the Engagement

- Install an initial operating model with roles, milestones, and an execution cadence spanning product, support operations, marketing, and fundraising.

- Create multi-year projections aligned to pricing, volume assumptions, staffing, and operating expenses.

- Prepare investor-ready materials, including a clear capital ask and valuation framing.

- Build a website to support early interest capture and partner conversations.

What I Changed:

Operating Cadence and Accountability

- Built an initial operating rhythm by defining milestones, roles, responsibilities, and execution plans across functions.

- Created a documented workflow covering intake, remote access, diagnostics, resolution, escalation, and follow-up.

Financial Visibility and Decision Support

- Created a multi-year financial model connecting pricing strategy, customer volume assumptions, staffing needs, and operating expenses.

- Documented explicit performance milestones, including customer volume targets and revenue goals used for planning.

- Aligned pricing logic with the operating plan so staffing expectations stayed consistent with the service economics.

Fundraising

- Structured investor materials so the business, market, economics, and operating plan were coherent and defensible.

- Participated in pitch meetings with prospective investors and stakeholders, presenting the operating plan and scaling path.

- Translated investor questions into follow-up actions that tightened assumptions and clarified next steps.

Process, Tools, and Delivery Systems

- Built the website to communicate the value proposition and service real customers

- Positioned the service around affordability and convenience using comparisons to common alternatives.

- Evaluated distribution options and partner strategies, including reseller and white-label channels for remote computer repair technicians.

Conclusion

I helped to make priorities clearer and reduce rework. The team could review progress against milestones instead of debating direction repeatedly.

Follow-through became measurable by turning assumptions into a pro forma and explicit targets. This improved decision quality because staffing, throughput, and pricing could be evaluated together, and investor conversations had concrete backing.

Transferable Value

- Early-stage operational diagnostics and operating model design.

- Service delivery workflow definition and standardization.

- Design that aligns product, go-to-market, and fundraising.

- Financial modeling and pro forma development tied to operational assumptions.

- Investor narrative structuring, capital planning, and diligence preparation.

- Market-facing positioning that clarifies a technical service for buyers and partners.

- Partner and distribution strategy evaluation, including reseller and white-label options.